All Categories

Featured

Table of Contents

They maintain happening. I absolutely think that is the best security you have. Let's take a look at them in order. In my opinion, Claims Paying Capability of the service provider is where you base it (tax deferred fixed annuity). After that you can glimpse at the state warranty fund if you wish to, but bear in mind, the annuity mafia is seeing.

They understand that when they put their money in an annuity of any type of kind, the company is mosting likely to back up the insurance claim, and the sector is looking after that as well. Are annuities ensured? Yeah, they are - guaranteed annuities calculator. In my viewpoint, they're safe, and you must go right into them checking out each provider with confidence.

Historical Annuity Rates

If I placed a suggestion in front of you, I'm also putting my certificate on the line. Keep in mind that (are annuities at risk). I'm very positive when I placed something before you when we chat on the phone. That doesn't mean you have to take it. You could claim, "Yes, Stan, you stated to purchase this A-rated business, but I actually feel much better with A double and also." Penalty.

I totally understand that. Bear in mind, we're either marrying them or dating them. Then we have the Claims Paying Capacity of the carrier, the state guaranty fund, and my close friends, that are unidentified, that are circling with the annuity mafia. Just how about that for an answer? That's an accurate answer of somebody who's been doing it for a really, really long time, and who is that someone? Stan The Annuity Guy.

People normally get annuities to have a retirement revenue or to build savings for an additional purpose. You can get an annuity from a licensed life insurance policy agent, insurance company, economic planner, or broker - indexed variable annuity. You ought to speak to an economic adviser about your requirements and objectives prior to you get an annuity

The distinction in between both is when annuity settlements start. permit you to save cash for retirement or other factors. You don't need to pay tax obligations on your profits, or contributions if your annuity is a specific retired life account (IRA), until you take out the incomes. enable you to create a revenue stream.

Deferred and prompt annuities use a number of alternatives you can choose from. The choices provide different levels of prospective danger and return: are assured to earn a minimum passion rate.

Cash Value Annuity

Variable annuities are higher risk due to the fact that there's an opportunity you can lose some or all of your cash. Set annuities aren't as risky as variable annuities due to the fact that the investment danger is with the insurance company, not you.

If efficiency is low, the insurance policy company births the loss. Fixed annuities guarantee a minimal rate of interest, generally in between 1% and 3%. The business might pay a greater rate of interest than the assured rate of interest - when can you cash out an annuity. The insurer figures out the rates of interest, which can transform month-to-month, quarterly, semiannually, or yearly.

Index-linked annuities reveal gains or losses based upon returns in indexes. Index-linked annuities are a lot more intricate than repaired postponed annuities. It is necessary that you understand the attributes of the annuity you're considering and what they mean. Both legal features that impact the quantity of rate of interest attributed to an index-linked annuity one of the most are the indexing approach and the engagement price.

Each relies upon the index term, which is when the firm calculates the rate of interest and credit histories it to your annuity (what is the best annuity rate). The establishes just how much of the increase in the index will certainly be made use of to compute the index-linked passion. Other important functions of indexed annuities include: Some annuities top the index-linked rate of interest

Not all annuities have a flooring. All dealt with annuities have a minimal guaranteed worth.

Other annuities pay compound interest throughout a term. Substance interest is passion made on the money you conserved and the rate of interest you make.

Retirement Annuity Example

If you take out all your money before the end of the term, some annuities won't attribute the index-linked passion. Some annuities might attribute only component of the interest.

This is because you birth the investment risk as opposed to the insurance provider. Your representative or financial advisor can help you decide whether a variable annuity is ideal for you. The Securities and Exchange Commission categorizes variable annuities as safeties because the performance is stemmed from supplies, bonds, and other investments.

Purchasing Annuities Retirement

Discover more: Retirement ahead? Consider your insurance coverage. An annuity contract has two phases: an accumulation phase and a payout stage. Your annuity gains rate of interest throughout the accumulation phase. You have several choices on exactly how you add to an annuity, depending on the annuity you get: enable you to pick the moment and quantity of the repayment.

enable you to make the exact same repayment at the exact same interval, either monthly, quarterly, or every year. The Irs (IRS) regulates the taxation of annuities. The internal revenue service allows you to postpone the tax on incomes till you withdraw them. If you withdraw your revenues prior to age 59, you will possibly need to pay a 10% very early withdrawal fine along with the tax obligations you owe on the rate of interest gained.

Annuity Definition In Finance

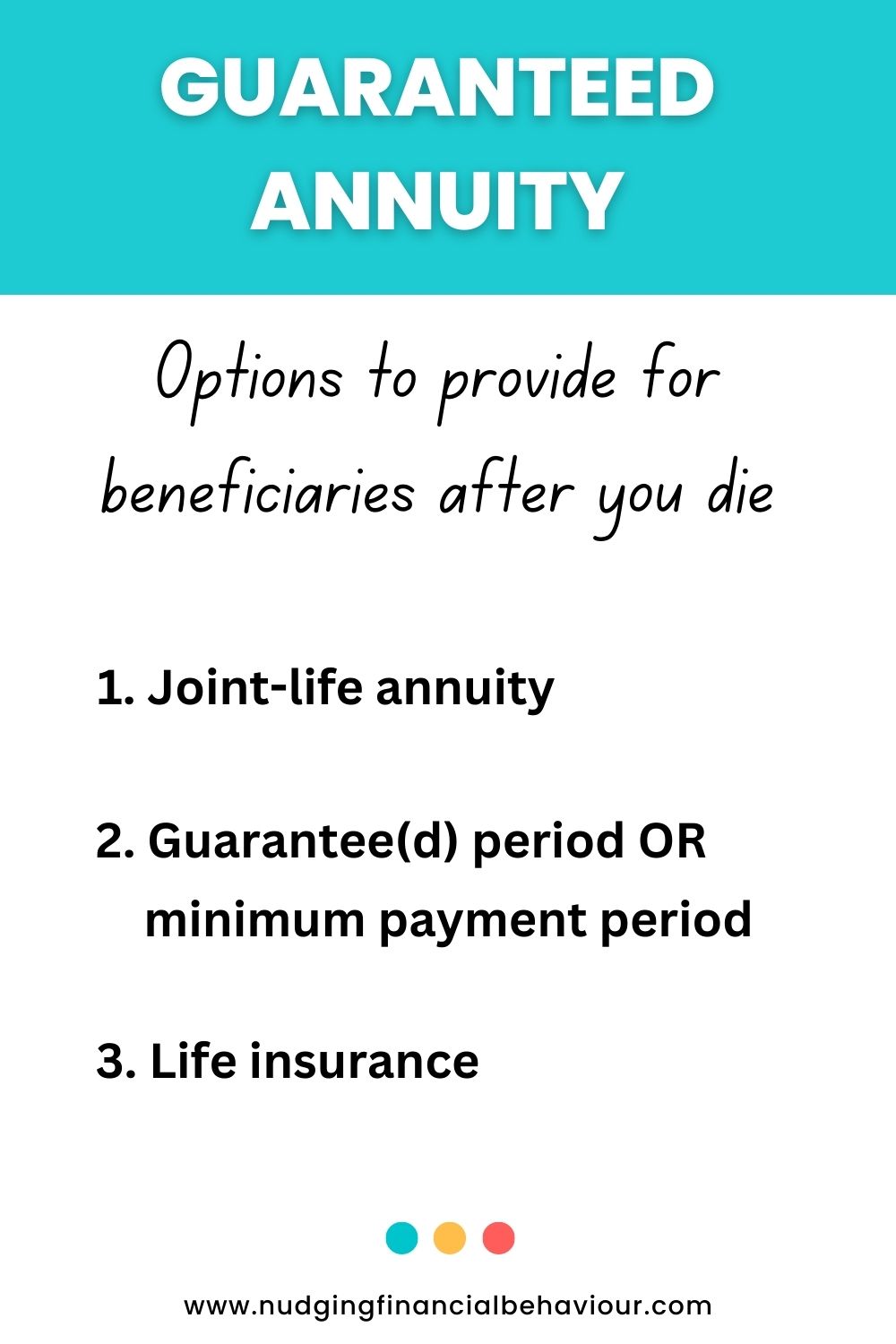

After the accumulation stage finishes, an annuity enters its payment stage. This is in some cases called the annuitization phase. There are numerous options for getting payments from your annuity: Your business pays you a repaired quantity for the time stated in the contract. The business pays to you for as long as you live, however there are none settlements to your beneficiaries after you die.

Lots of annuities charge a fine if you take out money prior to the payout stage - immediate annuity quote. This penalty, called an abandonment cost, is typically greatest in the early years of the annuity. The cost is often a portion of the withdrawn money, and typically starts at about 10% and goes down yearly until the surrender duration mores than

Table of Contents

Latest Posts

Exploring Variable Vs Fixed Annuities A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different Retirement Plans Why Choosin

Understanding Financial Strategies Everything You Need to Know About Financial Strategies What Is Annuity Fixed Vs Variable? Advantages and Disadvantages of Fixed Income Annuity Vs Variable Growth Ann

Exploring Fixed Index Annuity Vs Variable Annuities Everything You Need to Know About Retirement Income Fixed Vs Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of

More

Latest Posts